Shooting Star Pattern Candlestick

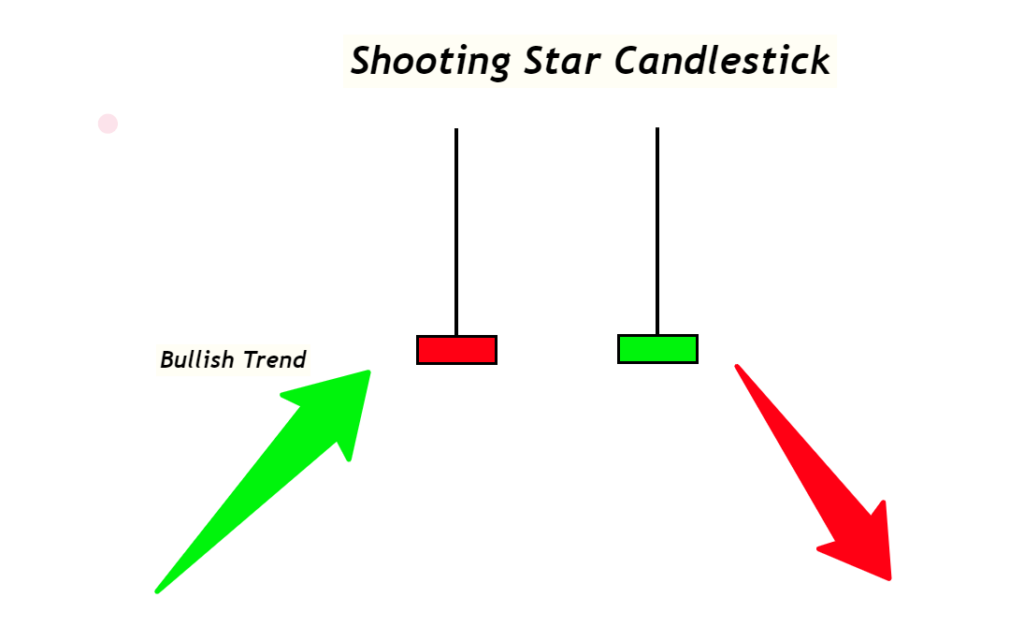

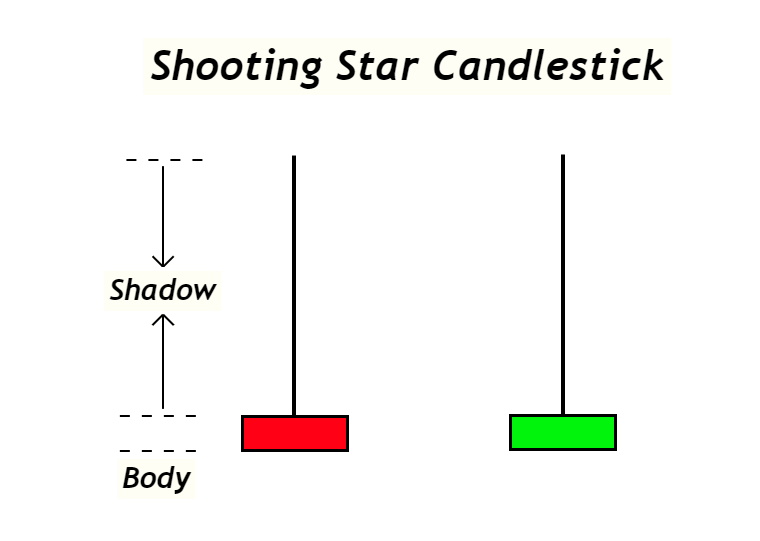

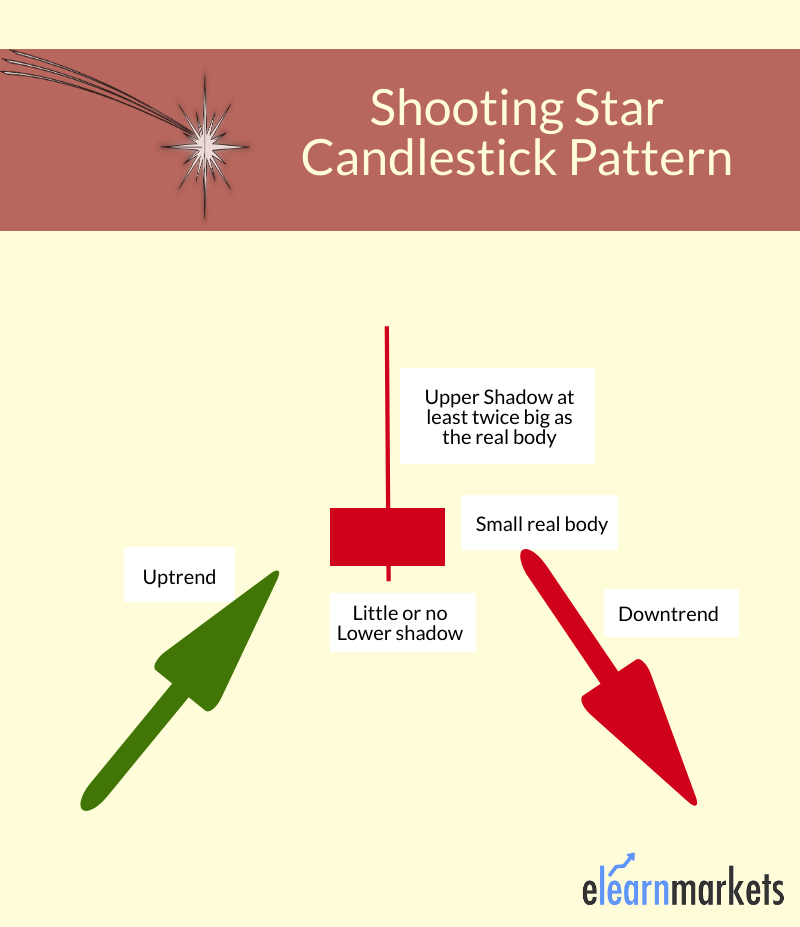

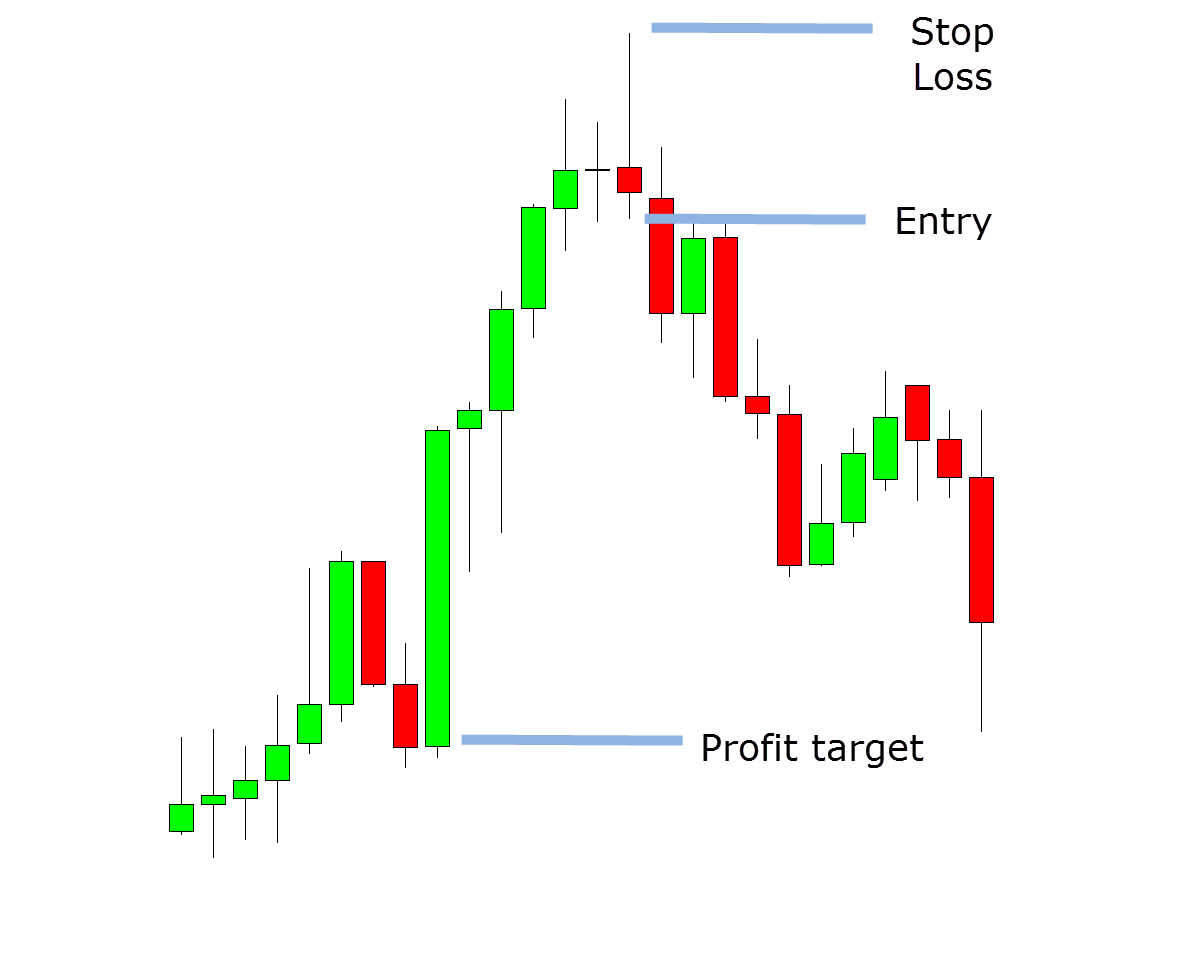

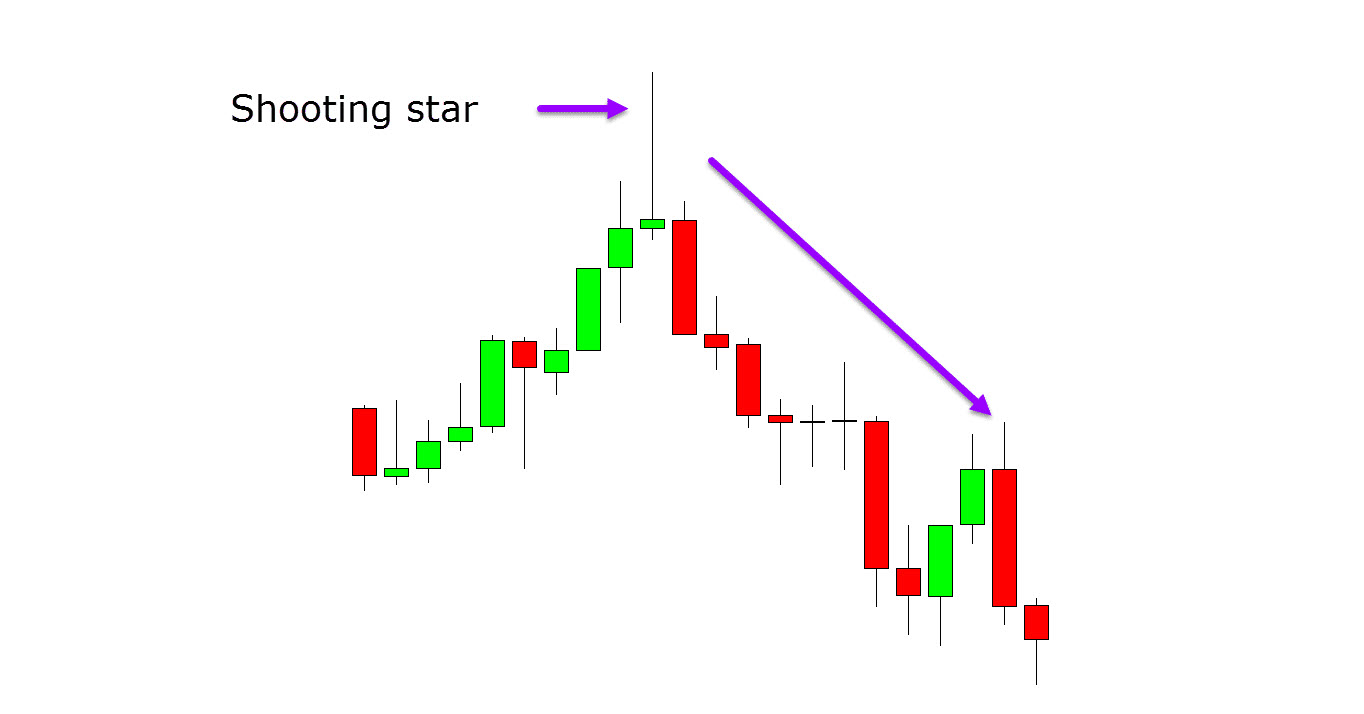

Shooting Star Pattern Candlestick - This pattern is easy to understand and can be combined with other technical indicators to take trades. The shooting star is a powerful chart pattern that signals potential price reversals. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Each bullish candlestick should create a higher high. Web shooting star patterns indicate that the price has peaked and a reversal is coming. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. It appears after an uptrend. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. This pattern is the most effective when it forms after a series of rising bullish candlesticks. Each bullish candlestick should create a higher high. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. It appears after an uptrend. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. The shooting star is a powerful chart pattern that signals potential price reversals. Web shooting star patterns indicate that the price has peaked and a reversal is coming. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. This pattern is easy to understand and can be combined with other technical indicators to take trades. This pattern is the most effective when it forms after a series of rising bullish candlesticks. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. This pattern is easy to understand and can be combined with other technical indicators to take. This pattern is the most effective when it forms after a series of rising bullish candlesticks. Each bullish candlestick should create a higher high. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. The shooting star is a powerful chart. Web shooting star patterns indicate that the price has peaked and a reversal is coming. This pattern is the most effective when it forms after a series of rising bullish candlesticks. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. After an uptrend, the shooting star pattern can signal. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. Each bullish candlestick should create a higher high. It appears after an uptrend.. This pattern is the most effective when it forms after a series of rising bullish candlesticks. This pattern is easy to understand and can be combined with other technical indicators to take trades. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. This pattern is easy to understand and can be combined with other technical. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. It appears after an uptrend. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at. Web shooting star patterns indicate that the price has peaked and a reversal is coming. Each bullish candlestick should create a higher high. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow,. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web shooting star patterns indicate that the price has peaked and a reversal is coming. This pattern is a prime example of how candlestick formations can provide insightful information about market sentiment and possible price movements. Web a shooting star candlestick. It appears after an uptrend. Each bullish candlestick should create a higher high. This pattern is the most effective when it forms after a series of rising bullish candlesticks. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. After an uptrend, the shooting star pattern can signal to traders that. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. This pattern is easy to understand and can be combined with other technical indicators to take trades. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. Web shooting star candlestick pattern is among the most popular patterns traders use to identify a potential trend reversal. The shooting star is a powerful chart pattern that signals potential price reversals. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. This pattern is a prime example of how candlestick formations can provide insightful information about market sentiment and possible price movements. It appears after an uptrend. Each bullish candlestick should create a higher high. Web in technical analysis, the shooting star candlestick pattern plays a pivotal role in signaling potential bearish reversals.A Complete Guide to Shooting Star Candlestick Pattern ForexBee

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

Shooting Star Candlestick Pattern (How to Trade & Examples)

What Is Shooting Star Candlestick With Examples ELM

Shooting Star Candlestick Pattern How to Identify and Trade

15 Candlestick Patterns Every Trader Should Know Entri Blog

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

Candlestick Patterns The Definitive Guide (2021)

This Pattern Is The Most Effective When It Forms After A Series Of Rising Bullish Candlesticks.

It Is A Popular Reversal Candlestick Pattern That Occurs Frequently In Technical Analysis And Is Simple And Easy To Identify.

Web Shooting Star Patterns Indicate That The Price Has Peaked And A Reversal Is Coming.

Related Post: