Broadening Wedge Pattern

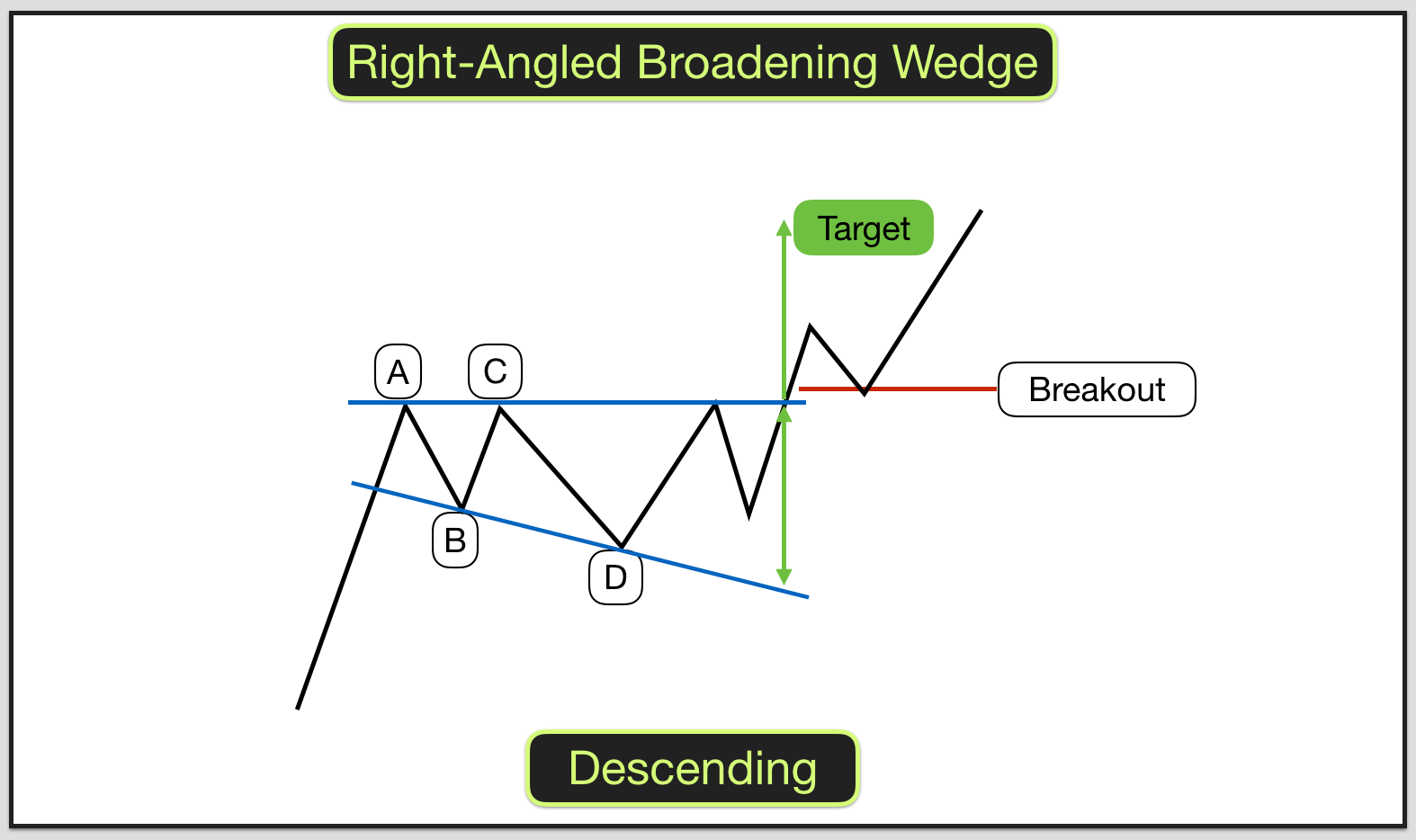

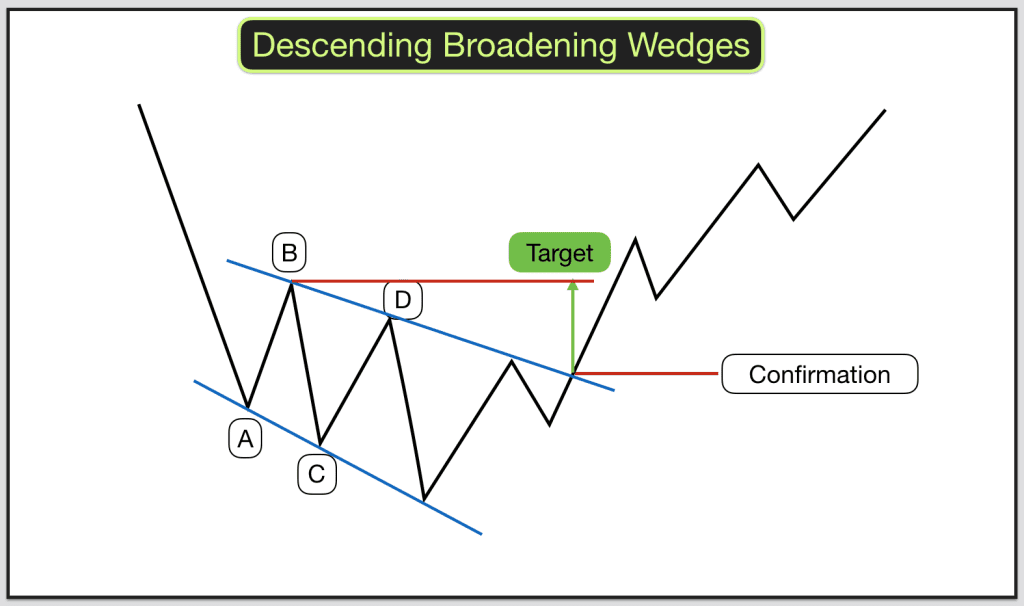

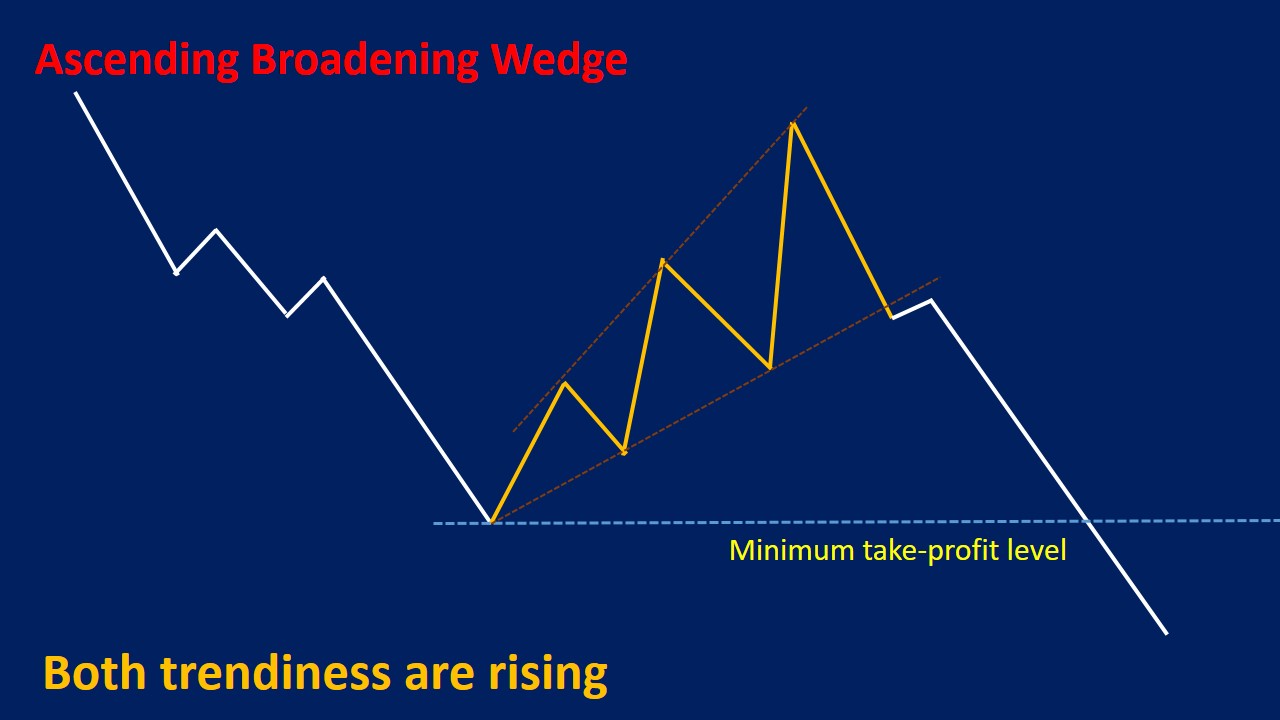

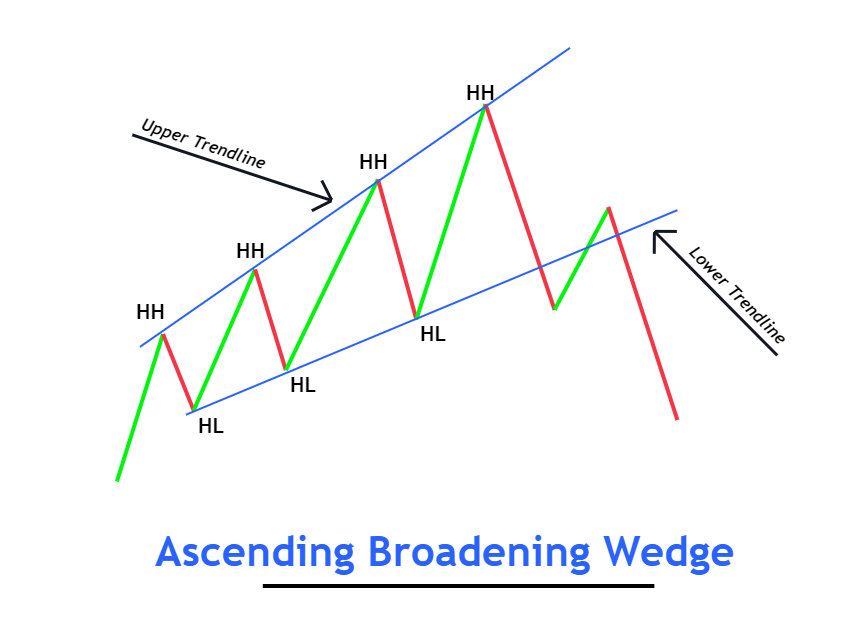

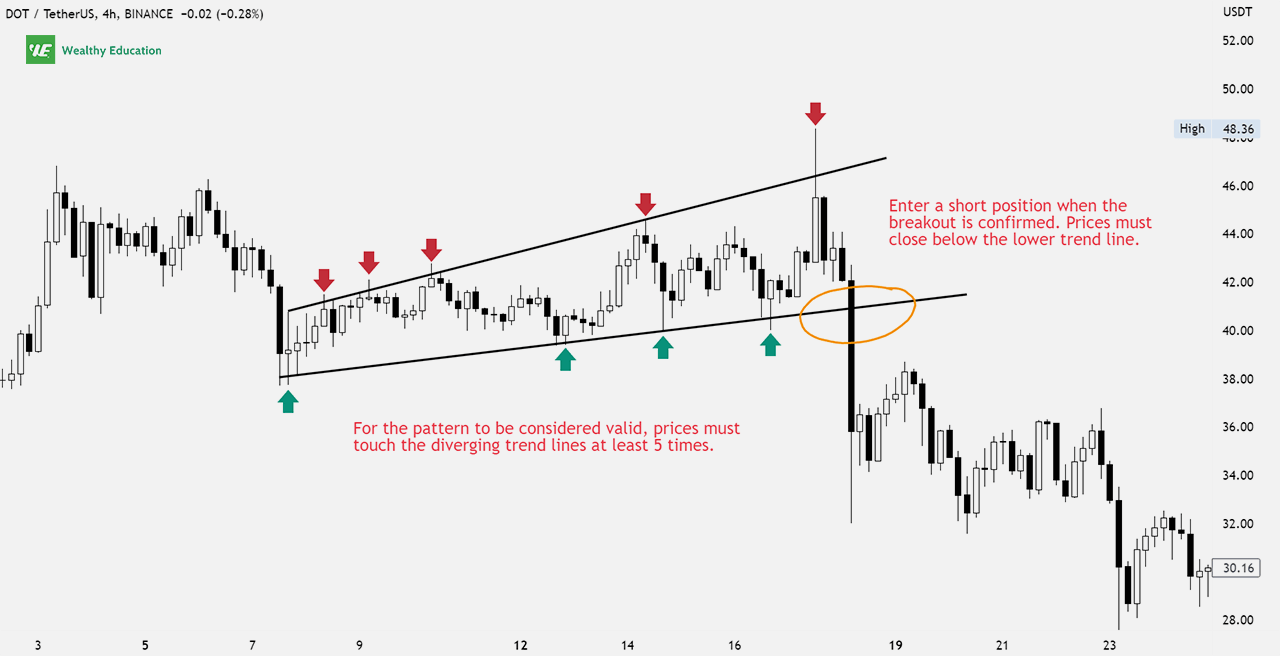

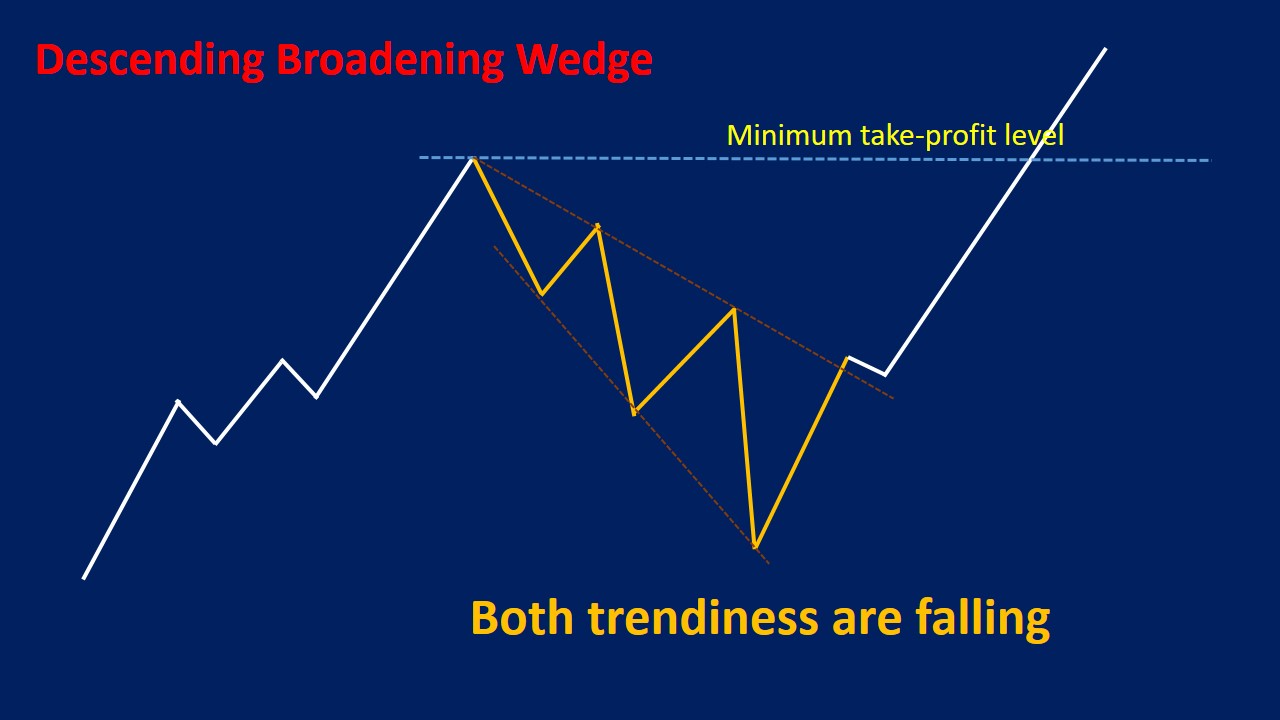

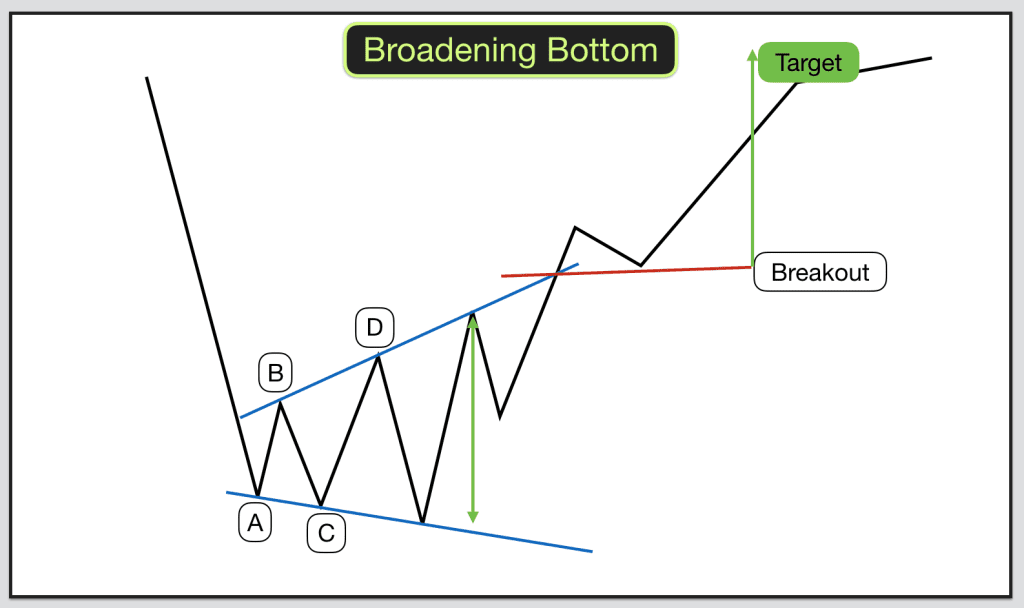

Broadening Wedge Pattern - Web descending broadening wedge has the appearance of a bearish megaphone pattern. Second, bitcoin has formed a three drives. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. It is represented by two lines, one ascending and one descending, that diverge from each other. Web in a wedge chart pattern, two trend lines converge. Web while symmetrical broadening formations have a price pattern that revolves about a horizontal price axis, the ascending broadening wedge differs from a rising wedge as the axis rises. This pattern is characterized by increasing price volatility, and it’s diagrammed as two diverging trend lines—one ascending and the other descending. It is created by drawing two diverging trend lines that connect a series of price peaks and troughs. Expanding wedge and broadening wedge pattern. Web together, falling and rising wedges make up examples of bullish wedge patterns and bearish wedge chart patterns with contrasting meanings. Expanding wedge and broadening wedge pattern. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Web when there is a partial rise, in 8 out of 10 cases, the result is a downward breakout. We provide a description of each pattern and its implications. It is characterized by increasing price volatility and diagrammed as two diverging trend lines, one rising. We also review the literature in order to find their deterministic cause. When the broadening wedge is aligned horizontally, the price makes higher highs at the top and lower lows at the bottom. Web a broadening formation is a price chart pattern identified by technical analysts. For more information see pages 81 to 97 of the book encyclopedia of chart patterns, second edition and read the following. Web together, falling and rising wedges make up examples of bullish wedge patterns and bearish wedge chart patterns with contrasting meanings. It means that the magnitude of price movement within the wedge pattern is decreasing. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. We provide a description of each pattern and its implications. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next.. It is formed by two diverging bullish lines. Web a descending broadening wedge forms as price moves between the upper resistance and lower support trend lines multiple times as the trading range expands during the downtrend in price. Web a broadening formation is a price chart pattern identified by technical analysts. Web a broadening wedge forms when the price is. Beyond slope direction as a key classifier, there are also pattern varieties based on volatility behavior. Web the broadening wedge pattern is a technical chart pattern characterized by diverging trend lines, forming a shape that resembles a widening wedge. We provide a description of each pattern and its implications. Wedges signal a pause in the current trend. An ascending broadening. Web descending broadening wedge has the appearance of a bearish megaphone pattern. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The ascending broadening wedge is a chart pattern that tends to disappear in a bear. Web the ascending broadening wedge pattern is a significant chart pattern in technical analysis, recognized for its distinctive structure and bearish implications. The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. When you encounter this formation, it signals that forex traders are still deciding. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. The ascending broadening wedge is a chart pattern that tends to disappear in a bear market. Beyond slope direction as a key classifier, there are. Web a broadening wedge pattern is a price chart formations that widen as they develop. Second, bitcoin has formed a three drives. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Expanding wedge and broadening wedge pattern. In other words, in a broadening wedge pattern, support and resistance lines diverge as. Web the broadening wedge pattern is a technical chart pattern characterized by diverging trend lines, forming a shape that resembles a widening wedge. If we compare broadening wedges, they are the flip side of regular wedges. Web the broadening wedge pattern is a chart pattern recognized in technical analysis, used by traders and analysts to predict the potential future price. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. Most often, you'll find them in a bull market with a downward breakout. Web descending broadening wedge has the appearance of. If we compare broadening wedges, they are the flip side of regular wedges. Web the broadening wedge pattern, also known as the megaphone pattern or broadening formation, is an important chart pattern used by technical analysts to identify potential breakouts and. It is formed by two diverging bullish lines. Web an ascending broadening wedge is a bearish chart pattern (said. We also review the literature in order to find their deterministic cause. Read this article for performance statistics and trading tactics, written by internationally known author and trader thomas bulkowski. Expanding wedge and broadening wedge pattern. Web ascending broadening wedge: Web the broadening wedge is a chart pattern that is formed when the price of an asset moves within two diverging trendlines, resembling a widening triangle or wedge shape. When you encounter this formation, it signals that forex traders are still deciding where to take the pair next. We provide a description of each pattern and its implications. Web first, as shown above, bitcoin has formed a falling broadening wedge chart pattern. In other words, in a broadening wedge pattern, support and resistance lines diverge as the structure matures. It is created by drawing two diverging trend lines that connect a series of price peaks and troughs. In most cases, this pattern results in a strong bullish breakout. Web an ascending broadening wedge is a bearish chart pattern (said to be a reversal pattern). This guide has it all. An ascending broadening wedge is confirmed/valid if it has good oscillation between the two upward lines. The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. Web a technical chart pattern recognized by analysts, known as a broadening formation or megaphone pattern, is characterized by expanding price fluctuation.How to trade Wedges Broadening Wedges and Broadening Patterns

Widening Wedge Chart Pattern

How to trade Wedges Broadening Wedges and Broadening Patterns

How to trade Wedges Broadening Wedges and Broadening Patterns

Broadening Wedge Pattern Types, Strategies & Examples

Ascending Broadening Wedge Definition ForexBee

Broadening Wedge Pattern (Updated 2023)

Broadening Wedge Pattern Types, Strategies & Examples

How to trade Wedges Broadening Wedges and Broadening Patterns

Trading The Broadening Wedge Your Start To Profit Guide

The Upper Line Is Resistance And The Lower Line Is Support.

Know About Ascending Broadening Wedge Pattern That Signifies Market Volatility, Wherebuyers Try To Stay In Control, And Sellers Try To Take Control Of The Market.

Web The Broadening Wedge Pattern Is A Technical Chart Pattern Characterized By Diverging Trend Lines, Forming A Shape That Resembles A Widening Wedge.

Web The Broadening Wedge Pattern Is A Chart Pattern Recognized In Technical Analysis, Used By Traders And Analysts To Predict The Potential Future Price Movements Within A Specific Financial Market.

Related Post: